I have absolutely no clue! It’s probably not. But maybe.

Either way, I’ve officially dipped my crusty little Hobbit toes into the murky waters of Stocks & Shares! Here’s a breakdown of why, how and where!

While investing in Stocks and Shares is profoundly mystifying to me, one thing I’m certain of is that with the fate of our economy at the mercy of a bunch of unbearable, bickering, plummy dip-shits, I don’t feel safe ploughing another dime into property until the dust settles (excluding mortgage debt reduction)! Where a shrewd property investor may see opportunity, I cower in fear and take several nasty dumps in my pants!

As I’ve been saying for a while now, unless an absolute bargain comes along (which it won’t), further investment in bricks and mortar is officially off my table for the foreseeable future.

Equally as repulsive as the current property market, is the idea of stockpiling more pennies into one of my dog-shit savings accounts’, which all seem to be legalised means of euthanising my already minuscule net worth. Of course, like a meandering and senseless shit-stain, I’m still doing it. Who else is with me?

My excuse is, I’ll never know when I’ll need quick access to a butt-load of ransom money. I hear the following exploit is circulating:

Hello! I am a representative of the Chaos hacking group. We are aware of your intimate adventures on the Internet. We know that you love adult sites and we know about your sex addictions. You have very interesting and unique taste (do you understand what I mean?). When browsing these pages, your device’s camera turns on automatically. What you watch is recorded and saved on our server. At the moment, several compromising video recordings have been collected. All your contacts in this email inbox and in messengers will receive these clips. If you do not want this, transfer 2,000.00 GBP to our unique Bitcoin wallet. As soon as your transfer is confirmed, all your contacts and video recording will automatically delete immediately. You decide … Pay or live in hell with shame …

That threat could be a very depleting and colossal reality for me.

To clarify, I’m not telling anyone to refrain from starting or continue investing in property (or to stop having “intimate adventures on the Internet“, just make sure you securely apply tape over your laptop’s camera lens).

For those contemplating the beautiful journey of property investment, don’t be discouraged by my petulance – I’m rebelling against the machine because I’ve already invested in property! If that wasn’t the case, hand on heart, I would be gearing up to pounce onto the property market. I don’t think anything beats property long-term.

So what am I supposed to do?

Investing in Stocks & Shares Vs Property

I’ve always been keen on diversifying investments in order to create multiple income streams (in case one stream gets clogged-up and tumbles tits-up!), and it’s a strategy all financial ‘experts’ seem to endorse. I’ve tried to diversify as much as my risk appetite will allow, which sadly means my options are woefully stark. However, the one investment type that has historically captured my interest on more than one occasion, yet scared the shit out of me at the same time, is the stock market.

I really don’t understand the nuances of how stocks and shares work, so I don’t like them. Don’t even get me started on the lingo. It’s a different world.

I don’t like things I don’t understand! Too many idiots salivate in envy when they hear the success stories of others, and they don’t care how or why, they just want ‘in’ – even if they don’t have a clue. I ain’t that particular type of idiot. But I am the type of buffoon that can easily find primitive distractions to stay clear from learning ‘investment methods’ to the point of ample understanding *yawn*

I think that’s why many of us (landlords) feel comfortable with property, because most of us are forced to get a taste, albeit a limited spoon full, when purchasing our own home. Plus, the whole property gig really isn’t that difficult to grasp. But more so, it’s a tangible asset; I can physically see where my money has been swindled, and that provides great comfort. When we invest in stocks & shares we’re essentially buying virtual numbers. It’s uninspiring. It’s bullshit.

However, there’s still an alluring charm to it’s passive and lightweight nature. Probably because it doesn’t include the risk of taking on an adult-baby that mysteriously forgets to pay rent, or thinks it’s acceptable to take a dump anywhere other than in the bog.

Perhaps that’s why, over the past several years, I’ve mildly looked into investing in stocks & shares on a few occasions, and even almost came close to pulling the trigger. Alas, I’ve always managed to scamper away, knowing that if I fired, I would be one of those idiots blindly hitting and hoping.

If I go down in flames, I don’t want any excuses.

Unfortunately, I was recently inspired to look into investing once again, thanks to a Wealthify.com advert, which has been heavily airing on LBC radio station. In the 30 second plug, those assholes’ managed to sink their filthy little fangs into my weak mind! They really have nailed the art of capturing the attention of aspiring “stock brokers” that don’t have the foggiest, by making their solution to investing sound simple and intriguing.

Fair play to them. But if this ends badly for me and my legacy, I will burn their fucking house to the ground.

Disclaimer / I’m not on the payroll!

Before going any further, let’s erect barriers to prevent any disputes and shenanigans!

Firstly, it’s imperative to understand that I’m NOT providing any financial advice, so you should not take it as such! The purpose of this blog post is to simply share the details of how and why I’ve decided to gamble and blow a portion of my savings on something other than property/BTL during the middle of the Brexit shit-storm.

Maybe I’ll inspire you, maybe I won’t.

I shouldn’t!

Secondly, I just want to state that this is NOT a sponsored blog post; none of the services/companies I mention have infiltrated my motives. I have not spoken to anyone directly or indirectly linked to any of the mentioned services. Understandably, there’s often scepticism behind the motive when a blogger/publisher shares financial services, so that’s why I wanted to make my position clear.

We good?

Back to Wealthify.com and investing in Stocks & Shares

I’ve bumped into Wealthify adverts quite a lot recently, so I think they’re on an almighty marketing spree, so you may have also received an earful of their marketing crap.

If you haven’t, rather than miserably failing at articulating their service, I’m just going to point you in the direction of a short 1.38min video-explainer I snatched from YouTube:

Wealthify aren’t offering anything new; I know that. They’re essentially a ‘mutual fund‘, which is a concept I do understand… because it’s relatively simple. However, I have historically avoided investing in mutual funds because when I previously looked into mutual fund trading platforms, like Hargreaves Lansdown, I found their fees to be intimidating. At least, it was for someone that merely wanted to throw some shit at the wall to see if it sticks. On a sidenote, a close friend of mine made a 30% return with his Hargreaves Lansdown mutual fund last year.

Yes, I’m very happy for him *grits teeth*

Anyways, here’s a breakdown of what I understand from Wealthy’s service (some of which has already been mentioned in the video):

Wealthify is a digital investment management company.

Simply, you deposit your hard-earned cash into your Wealthify account, and they’ll invest your money in diversified portfolios across different industries and countries (to spread your risk), which means we, as the investor, don’t need to get pinned down with any of the pain-staking minutiae details.

Unlike traditional single stock investments, we don’t have to individually pick and choose stocks to invest in; the whole point is that they will do it for you, which is what makes this solution so appealing to an absolute doofus. It’s pretty much the most basic means of investing in stocks & shares.

I know it’s not sophisticated and imagine it’s not the most lucrative way of investing. But it’s easy. And it’s a start.

They allow you to set the level of risk you wish to expose your investment to, from a scale of 1 – 5 (‘cautious’ to ‘adventurous’).

From what I understand, if you’re a bonafide wuss and consequently choose ‘cautious’ (the lowest risk bracket), 90% of your investment will be invested into fixed-rate bonds (which is relatively secure), and the remaining 10% will be investment into various stocks & shares, which are proportionality volatile to your chosen risk level.

If you’re the kinda’ person that’s ballsy enough to step into communal showers without wearing flip-flops, your stomach may entertain a risk level of 3+, in which case 70% of your capital will get invested into bonds, while the remaining will get invested into various other more volatile assets (proportionality volatile to your selected risk level).

They’re not the exact splits, but that’s the general gist of how it works.

To recap: choose your risk level, handover your cheese, and they’ll invest your funds across multiple global assets.

Minimum investment is £1.

Like property, this is a long-term play!! This is NOT a get rich quick scheme. Every article and independent video/article I have read only emphasises that.

My intention is to keep my money invested for an absolute minimum of 5 years! It will most likely be considerably longer.

After inputting how much you wish to invest, your desired risk level, and how long you intend to invest for, Wealthify projects your potential returns (based on past performances, I presume).

You can buy/sell at any time, you’re never locked in.

Everything can be controlled via their app (which has been praised for how intuitive it is).

Digital investment management companies are notorious for charging low fees compared to traditional investment platforms. I believe that’s the case because a lot of the process is computerised, as opposed to paying a wealth manager to manually pick and choose a tailored approach to investing your money.

Wealthify charges 0.7% a year on portfolios worth £250-£14,999, 0.6% for £15,000 to £99,999 and 0.5% for £100,000 and above.

Wealthify is not the only digital investment management company!

Plot Twist: I gave Wealthify.com the middle finger and went with Nutmeg.com instead!

Yup, SCREW Wealthify!

No, honestly, I’m sure they’re wonderful! It just wasn’t meant to be.

During my research phase, I discovered Nutmeg.com. For all intents and purposes, they seem to offer a very similar service to Wealthify.com and is a direct competitor. There are dozens of forum threads and blog posts that compare their services head-to-head. Both are UK based, which is cool.

The only reason I grabbed Nutmeg.com instead is because I noticed enough people complaining about the lengthy duration it takes to transfer money in and out of Wealthify. Here’s one pissy comment from their Reviews.co.uk profile:

2 weeks and my money i deposited still hasnt hit my account. Never known a financial institution to take so long to deposit money.

The issue seemed to be a common gripe among users.

I personally feel more comfortable using the service offering the quickest solution to transferring my money in and out. I’m an impatient chap *shrugs shoulders*

Signing up for Nutmeg.com

I won’t dither around these parts, I just want to say that it was a piece of cake to download the Nutmeg app and set up my investment portfolios. You can also do it online via their website.

How much I invested, my expected returns, and how how much risk I’ve taken!

Even though I’ve taken the plunge, I’m still a pussy – and don’t you forget it – so I haven’t invested too much to start with (I suppose it’s relative, though).

Here’s an overview of how I invested:Investment PortfolioRisk levelAssetsAmount investedExpected Annual Return (after costs and charges)Medium Risk6 / 10

Equities: 52.2%

Bonds: 47.3%

Other: 0.6% £700 +4.77% High Risk7 / 10

Equities: 62.9%

Bonds: 36.5%

Other: 0.6%£550 +5.06%

I’m assuming the expected returns are based on conservative averages, and since this is a gamble, the returns could be greater. Or less.

Obviously I’m counting on a lot greater, because I don’t think it’s worth putting too much on the line for a 4-5% return. But that’s precisely why I’m gambling experimenting.

Quick explanation of what’s going on

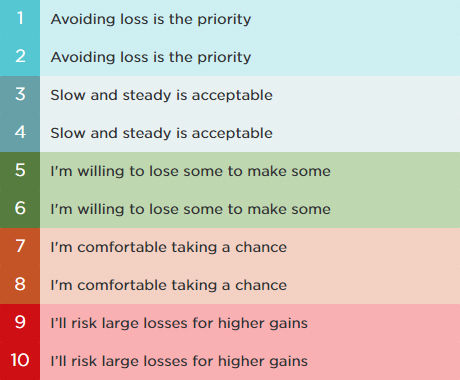

Nutmeg let’s you choose between a risk level of 1 – 10:

I created two separate portfolios, one with a level of 6, the other with 7.

I can create as many portfolios as I wish, and I can also change the risk levels for each existing portfolio.

I named my investment portfolios “Medium risk” and “High risk” for my own reference, it wasn’t anything administrated or automated by Nutmeg.

1.5% seems to be the rate of return from the average 1 year fixed savings accounts currently available! My investments are expected to make a return of 4.5%+.

To date, I’ve invested a total of £1250 just to see what happens. I’ll either start drip-feeding my investments on a monthly basis (which is easy to setup via the app), or make random lump-sum deposits, depending on how things go in the coming months.

Or, I may just pull my investment altogether if the situation starts to resemble a fucking calamity. At that point, the idea of being drained by a bullshit investment app may just be too much for my fragile ego, so I might just lose my God damn mind and blow what’s left on a one-night bender.

To be determined.

The results of investing with Nutmeg.com so far!

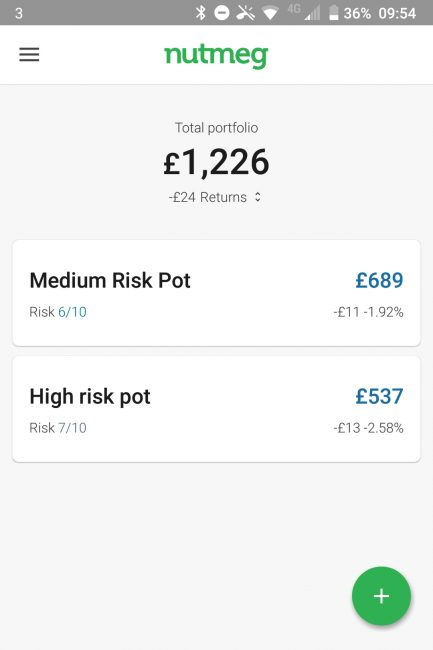

I opened my account in mid August, and I almost immediately got screwed and consequently slung myself out the window. Three days after investing I was £24 poorer! *slaps forehead*

Sweet Mary Mother of Jesus, WHAT THE SHITTING-CHRIST HAVE I DONE?!?

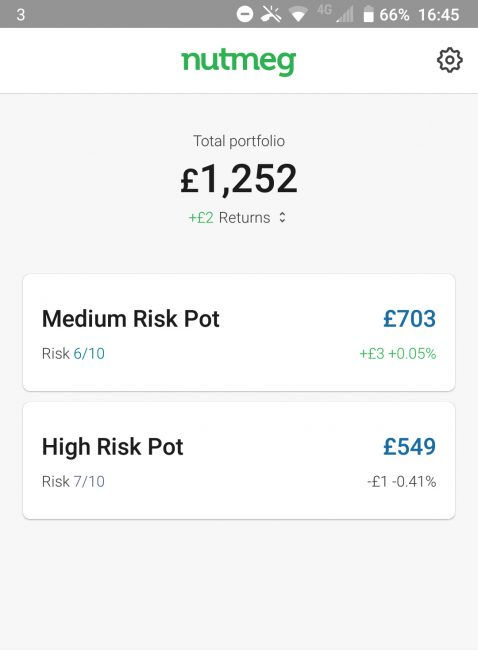

One tough and demoralised month later… there is a God, and he’s shining down on me from the Heavens!

I’ll NEVER DOUBT ANYTHING EVER AGAIN!! I’m officially two sweet nuggets richer. Read it and weep, suckers!

I plan on keeping the table below updated monthly, just in case anyone is interested in seeing how disastrously this all pans out.DateAmount investedCurrent ValueReturnsAugust 2019£1250£1226-£24September 2019£1250£1252+£2October 2019£1250£1243-£7November 2019£1250£1243-£7December 2019£1250£1254+£4January 2020£1250£1264+£14

So, is investing in Stocks & Shares a good alternative to BTL/Property?

Like I said, not a fucking clue! The Lord only knows!

But I’m in the game now.

I want to reiterate that I don’t know if this will be fruitful or not. I’m just trying something new, and I don’t recommend it. I do highly encourage everyone to look into different ways of diversifying in accordance to personal comfort levels, though.

What about you?

Couple of questions, if you don’t mind…

Do you plan on investing in property during the Brexit shit-storm? If not, what’s in store for your disposable income?

Are you already investing? If so, any tips/thoughts?

Are you using a digital investment management company like Wealthify or Nutmeg? If so, how’s it going for you?

As always, love & peace xoxo

Comments